s corp tax calculator excel

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad A Tax Advisor Will Answer You Now.

Payroll Calculator With Pay Stubs For Excel

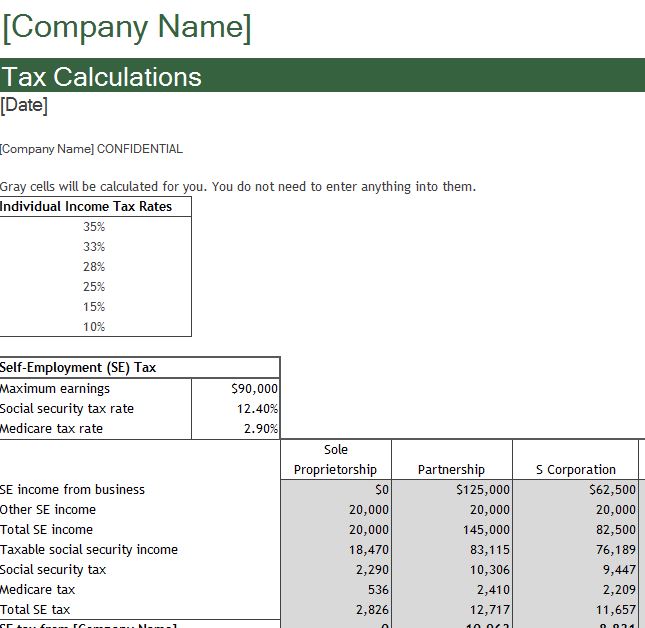

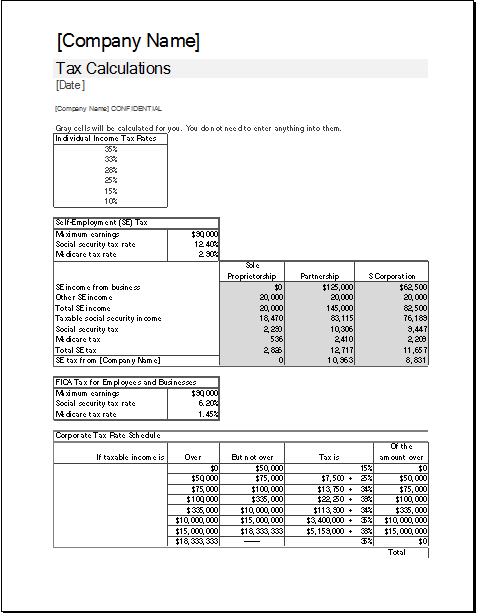

Federal income tax and employment tax for llcs and s corporations.

. Ad Track Everything In One Place. 10000 Questions Answered Every Day. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Calculating Your S-Corp Tax Savings is as Easy as 1-2-3. Browse discover thousands of brands. Corporate tax rate calculator for 2020.

Read customer reviews find best sellers. Want to join the live course to learn w. Instead you only pay payroll taxes on the salary you earn from your S corp.

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps S-Corp Business Filing And Calculator - Taxhub S-Corp Calculator Calculating Your S-Corp Tax. Explore The 1 Accounting Software For Small Businesses. Pin En Calculo Isr Con Excel.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. For example if you have a. Total first year cost of.

But as an S corporation you would only owe self-employment tax on the 60000 in. Basic Corporate Income Tax Calculator BTC BTC for. Business Tax Calculator My Excel Templates from.

S-corp Tax Calculator Free. This video breaks down the myths about the s-corporation through 3 reasons not to use the s-corp election for taxes. The Excel sales tax decalculator works by using a formula that takes the following steps.

1 Select an answer for each question below and we will calculate your S-corp tax savings. This calculator uses a four-step process to help you decide whether an LLC should elect to be taxed as an S corporation instead of accepting the default classification as a partnership or. A What is your.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Take the total price and divide it by one plus the tax rate. Lets look at some numbers to see how this works.

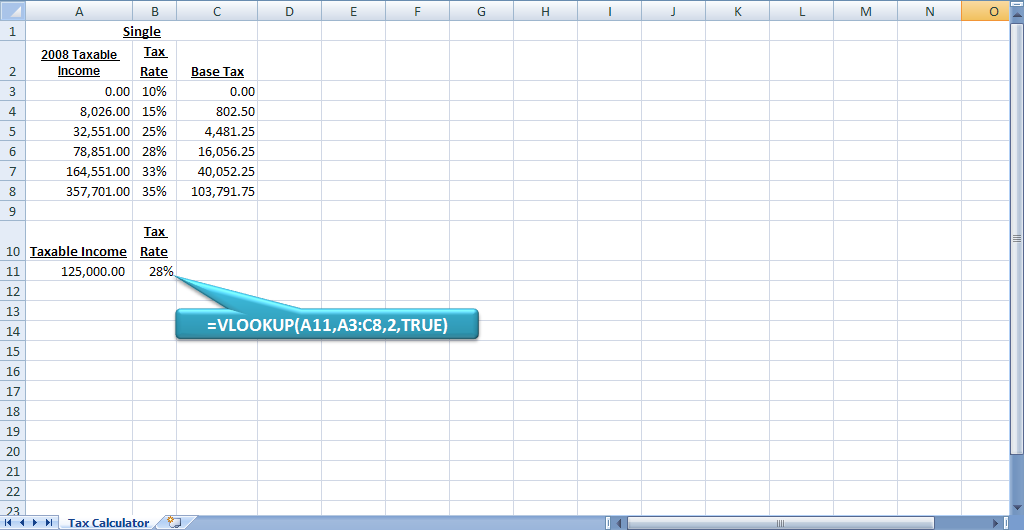

As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. VLOOKUPTaxableIncomeFederalTaxTable4 TaxableIncome -. Say you earn 150000 in revenue as the owner.

S Corp Tax Calculator Excel. Lets calculate your canadian corporate tax for the 2020 financial year. Excel Formula to Calculate Tax Federal Tax.

This page provides a list of income tax corporate tax withholding tax property tax GST stamp duty WCS and JSS calculators. Manage All Your Business Expenses In One Place With QuickBooks. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

Excel Template Tax Liability Estimator Mba Excel

Use This S Corporation Tax Calculator To Estimate Taxes

Tax Savings Calculator For Llc Vs S Corp Gusto

Payroll Calculator With Pay Stubs For Excel

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

S Corp Tax Secrets Tax Savings Strategies 2023 White Coat Investor

How To Calculate Income Tax In Excel

Calculate Corporate Tax Using Excel Youtube

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Corporate Tax Calculator Template For Excel Excel Templates

Calculate Your S Corporation Tax Savings Zenbusiness Inc

Excel Formula Help Nested If Statements For Calculating Employee Income Tax

Free 1099 Template Excel With Step By Step Instructions